Medicare Advantage has been going through some consistent and meaningful competitive moves as of recently. Due to such a high altitude of shifts, 2022 has proven to be quite a successful one for the market. In fact, the percentage of eligible beneficiaries that enrolled in a Medicare Advantage plan has exponentially risen. 2022 saw almost 42% of eligible beneficiaries apply for this plan. Which has been almost a 10% increase from five years ago when it was just a little more than 30%. We continue to observe how the Medicare Advantage market accelerates profitable plans. This is by learning from the current results, the trends chart has been quite a view.

On the contrary, other health plans can be seen struggling to keep up with the pace set by MAPD. Non-profit health plans and blue-branded health plans have struggled to find competitive growth against Medicare Advantage plans. There are rapid share gains and successful entries of new market entrants. We also see the emergence of private startup venture-backed plans which are on a high rise. Here are some successful and highly profitable trends. They will showcase a promising future for Medicare Advantage with the potential of consistent competitive growth are as follows:

2022 Medicare Advantage Trends at a Glance

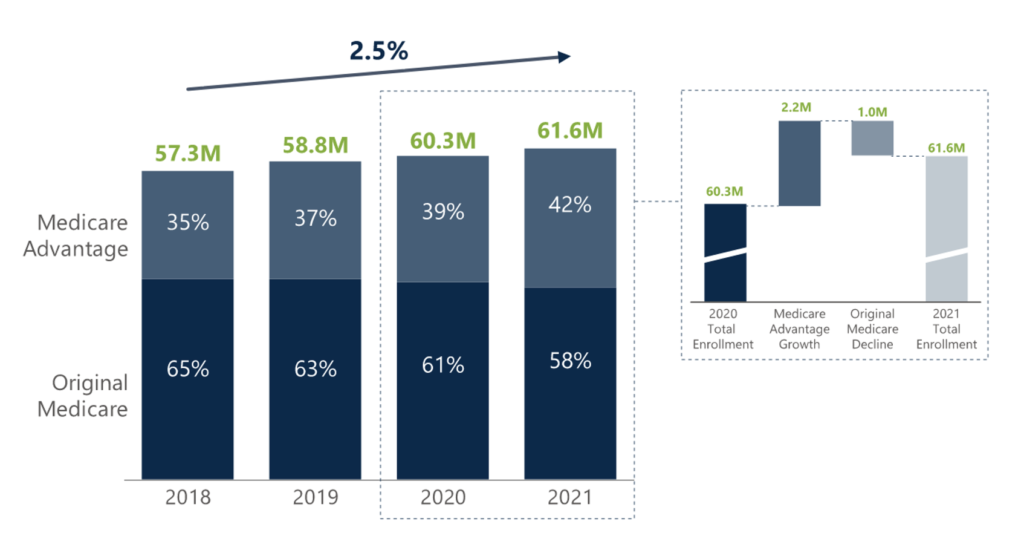

- Medicare Advantage showed growth of almost 10% this year. The eligible beneficiaries enrolling for the Original Medicare fell short by almost 3%. This shows the Medicare Advantage market penetration has been successful by 42%.

- MAPD plans are outpacing blue-branded plans as well as non-profit plans. With the total # accounting for almost 71% of all the accumulative enrolling beneficiaries of the market,. This is up from last year’s 69%.

- From the stock market’s Reports. United Health and Centene have been top performers. Their accumulative share growth over 4 points.

- A significant 9 out of 10 Medicare Advantage plan beneficiaries have also taken up prescription drug coverage. Almost 65% of these enrolled beneficiaries enjoy perks. For example, paying no premium other than the standard monthly Medicare Part B premium.

- Almost all of the MAPD plan enrollment beneficiaries would go on to pay less. This is less than what they would pay for Original Medicare Part A hospitalizations. This includes cost deductions made for inpatient stay of three or fewer days. However, even if the stay went on to be for six or more days, 53% incur higher costs. As compared to others with the traditional Medicare.

- 2022 saw that the average out-of-pocket costs for Medicare Advantage beneficiaries of $9200.

- More than 80% of MAPD Plan beneficiaries in 2022. Show they own plans with a give back premium option. These are from Medicare covering agencies based on quality ratings. Many people are seemingly doing well in their favor. The number rose four times in 2015 by totaling up to a whopping $12 billion in 2022.

Top 7 Medicare Advantage Trends in Sight

Following are some of the most successful trends. They highlighted a great year for the Medicare Advantage market, beneficiaries, and the federal regulators. These trends have continued to define the Medicare Advantage space in recent years. Let’s have a look.

1. Medicare Advantage Passed an Important Milestone

MAPD plans grew exponentially than any time in history ever. This resulted in the market surpassing a vital milestone that was certainly long overdue. In 2022, Medicare Advantage managed to pass over a significant hurdle. In 2022, more than 40% of the total 62 million MAPD plan eligible beneficiaries. Will be on the move and, are predicted to be enrolled by the end of the year. It grew overall with an increment of almost 1.3 million lives in 2022. There was almost 2.25 million new MAPD enrollment beneficiaries. Also they saw a whopping 950,000 decline in the Original Medicare. This clearly shows that the trend of Medicare Advantage taking over the enrollment numbers. Hence, Medicare Original beneficiaries has surely increased. As well as they will definitely be trending upwards.

2. Increasing Role of Medicare Advantage

Medicare Advantage is considered a great option for people on Medicare. However, over the last decade, with such consistently significant growth prospects, the role of MAPD has increased in importance. In 2022 alone, more than 26 million people readily enrolled in Medicare Advantage plans. This accounts for almost half of the total Medicare health care plan population. With $350 billion or almost 50% of the total federal

Medicare spending is net of premiums going towards the Advantage side. Any average Medicare beneficiary may have access to more than 30 Medicare Advantage plans. This is probably the largest number of available options that one could go for in the last decade.

3. Group Plans Becoming More Common

This might have come as a surprise to the general regulatory authorities pertaining to Medicare healthcare plans. One controversial matter has been how to work out Medicare if affiliated with an employment or union healthcare insurance plan. Nearly 20% of the MAPD beneficiaries are in group plans. Moreover, this goes on to show that what lack of knowledge and education was not able to achieve.

4. Diverse Member Population

Medicare Advantage plans have been open to all, irrespective of their gender, race, color, or anything for that matter. As long as you are a 65-year-old eligible person according to the Medicare rules and regulations, you are in. In 2020, the MAPD population comprised 25 million seniors. Of those 25 million, almost 60% were women corresponding to the factual research. However, if talking about racial diversity then, Medicare Advantage has strongly represented almost 52% of the Hispanic Americans. Also they saw 35% of the Asian Americans, and 49% of African American Medicare-eligible population.

5. Lower Senior Spending

One of the best things to have happened this year are lower health costs for seniors. In fact, according to a survey, six out of ten seniors didn’t even have a premium for their Medicare Advantage plan because that’s how low the spending was. While the statistics, data, and figures clearly demonstrate that lowered spendings have been delightful, there is no way to say that it would remain like this in the future.

6. Higher Quality of Care

One of the best inventions that came about to support Medicare Advantage is the Medicare Advantage Star rating system. It truly incentivized the whole Medicare Advantage ordeal to value consistency throughout the system metrics. With plans providing value for quality over quantity, the game has changed for the better. More than half of the total MAPD population, 52%, has been carrying around these plans for eight years before.

This is a shocker compared to how only 80% of Original Medicare members show more satisfaction than 99% of the Medicare Advantage members. This has significantly allowed the Medicare Advantage market to plan a steady, high-quality health care service provision for the beneficiaries, which can be seen through the lowered senior hospitalization rates.

7. Higher Enrollment Growth

An accumulative consensus of all the successful trends about Medicare Advantage can be compiled and shown as the totality of higher enrollment overall in the MAPD market. A whopping 60% increase is surely unmatched, given how the pandemic also adversely affected people’s financial situations. However, in the past decade, the number of Medicare Advantage plans has also increased by a whopping 161% allowing for more space to provide for all people.

Medicare Advantage Trends to Look Forward To

Now that we have concluded from our analysis that Medicare Advantage is treading successfully, here are some trends we can look forward to in the upcoming years.

- The federal health insurance market has seen a ton of development lately. Showing even more market growth for 2022. The number of plan contributions for the Medicare Advantage 2022 open enlistment season has increased.

- As Medicare Advantage enlistment keeps on developing, guarantors appear to be reacting by offering more plans and decisions to individuals on Medicare,” the specialists clarified. Payers are offering an aggregate of more than 3,800 Medicare Advantage plans in 2022.

- North of 1,400 plans is neighborhood favored supplier associations (PPOs), while more than 2,200 plans or almost 60% of all Medicare Advantage plans are health management organizations or HMOs.

- More plans were accessible to Medicare recipients in 2022 contrasted with earlier years. In 2022, recipients could access on normal 39 plans, establishing a standard for as far back as a decade by surpassing the number of plan choices that recipients could access in 2010 (31 plans) and 2021 (33 plans). Roughly 31 of those plans incorporated a Medicare doctor-prescribed medication plan.

- Almost six out of ten Medicare Advantage-physician recommended drug plans will charge no superior besides the Medicare Part B expense in 2022, giving virtually every Medicare Advantage enrollee admittance to a zero-dollar charge plan. The normal Medicare Advantage charge is relied upon to drop to $19 each month in 2022.

- More firms are offering SNPs and the quantity of SNPs is quickly developing.

- When significant payers delivered their Medicare Advantage contributions for 2022, they were inclining toward the upsides of advantage card contributions.

Conclusion

Medicare Advantage plans have been a ruling dimension of Medicare for quite a while now. It is safe to say that enrollment is your calling if you want to get enrolled this fall season. Therefore, you can continue to get your care from doctors, health care providers generally, and hospitals from the plan’s network if you have chosen HMO and even outside of the network if you have chosen PPO. Consequently, safeguarding and covering you against emergency and urgent care situations. Moreover, all SNP plans are mandated to provide Medicare drug coverage.

United Insurance is a national company helping members of the community choose the best Medicare options available. United’s mission is to guide seniors proactively by offering a clear picture of today’s healthcare coverage options. We bestow a true family environment built on honor and trust. Focus on dedication to professionalism, knowledge, and follow-through is our recipe for winning the hearts of our customers. Contact us to get started right away!

SOURCES:

- https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2021-enrollment-update-and-key-trends/

- https://www.chartis.com/as-medicare-advantage-enrollment-booms-healthcare-entities-need-to-plan-around-key-trends

- https://healthpayerintelligence.com/news/4-positive-trends-that-continue-to-define-medicare-advantage-plans

- https://www.risehealth.org/insights-articles/the-latest-trends-in-medicare-advantage-what-enrollment-star-ratings-and-plan-benefits-look-like-in-2021/

- https://healthpayerintelligence.com/news/trends-in-medicare-advantage-2022-open-enrollment-offerings